NAV's VAT M2M system

According to the amendment of the VAT law, the eVAT M2M system was launched on January 1, 2024. Although the use of the system is currently not mandatory, based on tax authority communications, it is expected that within a few years the new system will completely replace the current ÁNYK-AbevJava system. After this, tax returns can be submitted either by approving the proposed return on the eVAT web interface or through the M2M platform.

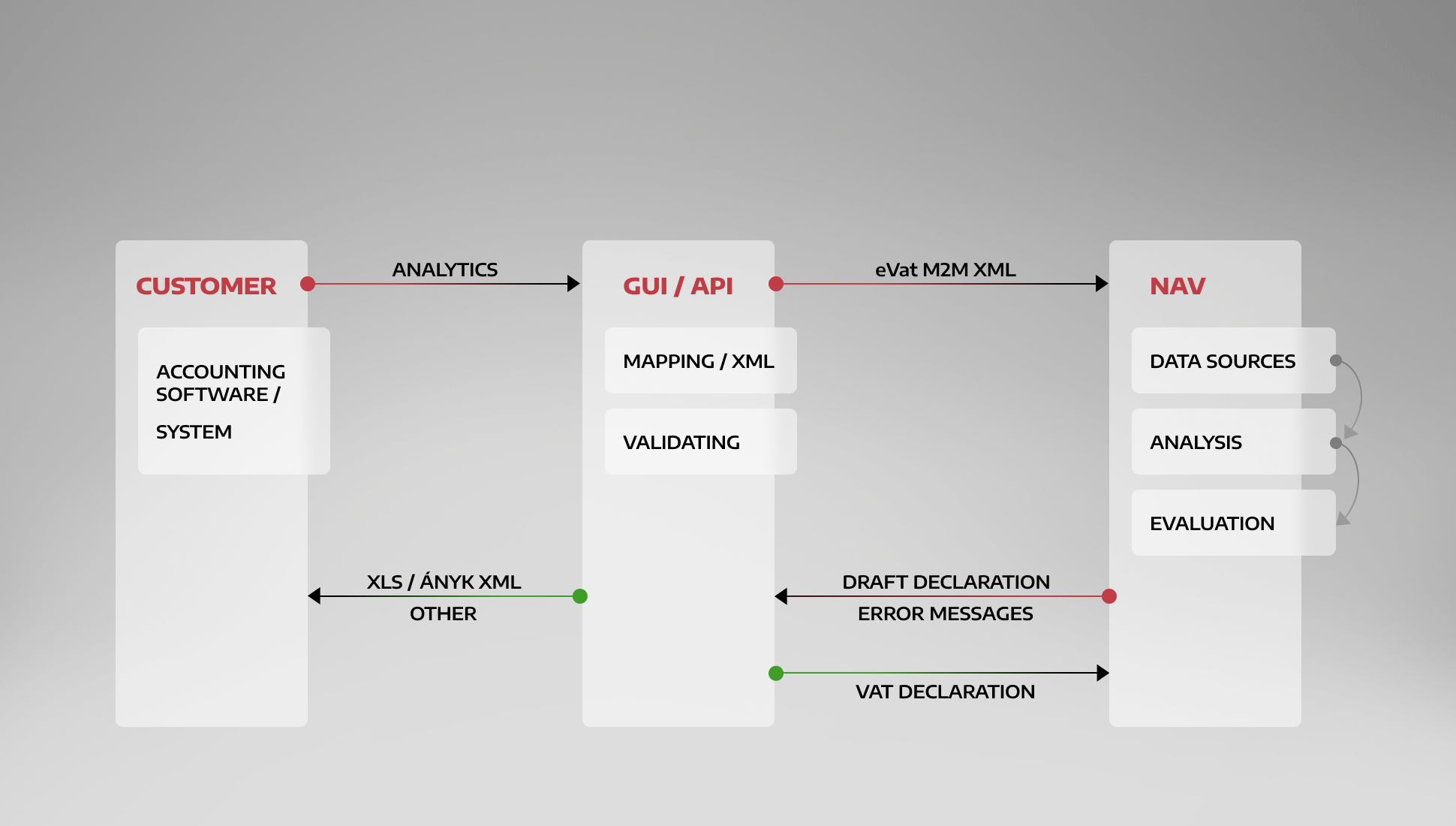

The essential element of the M2M system is the translation of the raw analytics compiled by the taxpayer into the tax code system offered by the tax authority (NAV) and the submission of data in a standard data structure, followed by validation by NAV. This allows for more efficient data processing and built-in error checking in the declaration process.

Using our new software:

Reduces the number of errors in reports

Who should use the eVAT M2M?

It is beneficial for companies where VAT declaration preparation is a complex task, requiring significant time and energy for compiling and submitting analytics and declarations.

Request a free consultation!

Why is it better than ÁNYK-AbevJava?

Faster and more secure tax declaration process

Replaces M sheets

Data validated by NAV and immediate correction options

Immediate query of issued and received invoices

15-day penalty-free self-check

15-day control moratorium (for reliable taxpayers)

and many other development possibilities...

How does the transition happen?

Since both IT and tax expertise are required for the transition, it's advisable to seek a company where both sets of knowledge are available at a high level. Through collaboration between Ecovis and Zengo, the comprehensive integration of companies' accounting or ERP systems with the NAV system can be undertaken.

The interface we've developed converts the data maintained on the taxpayer's side into the structure expected by the tax authority. Prior to conversion, a one-time "training" is necessary to ensure that your system interacts well with the NAV system (onboarding). This training is conducted by our tax specialist partner, Ecovis Tax Solution.

What can the Zengo interface do?

The Zengo interface, running locally or in its own cloud if required, essentially serves as a connector between your system and the NAV system. With this system, the tax preparer can upload and validate the prepared VAT return.

The system handles NAV response messages and displays them in an understandable format, making it easy to correct erroneous data even within the system. Additionally, the interface allows for export in any format, facilitating direct import of declaration data into the ÁNYK-AbevJava program if needed.

Why work with us on this?

Ecovis and Zengo collaborate with excellent expert colleagues in both IT and tax advisory fields, thus providing comprehensive business support and long-term secure operation.

Compared to large enterprise resource planning systems, we offer a faster and more cost-effective implementation, providing user-friendly solutions tailored to your needs.